A: Please complete a Department Signatory Form and have the Guild President sign it before submitting it to the Finance Office. The form is available here.

A Department Signatory Form documents the details and signatures of the nominated signatories for each Department. This means that a person can have access to the Department finances and other information if they are a listed signatory. Only the Head of Department can authorise expenses by members of the department.

Please also schedule training on general finance matters by emailing us at [email protected].

A: Every Department Head has access to NetSuite, the Guild’s online finance system. You should receive login details from Finance when you commence your term. NetSuite allows you to view financial reports for your department, including your budget, how much you have spent and exactly what you have spent it on.

A: A budget is essentially a plan of how much money a department has to spend for a certain period of time and it sets out how that money is to be spent. The budget is compiled in the last quarter of the financial year and takes effect from the next year.

Every department has a budget and can view the budget online on NetSuite. When you log in to NetSuite, there will be a tab that says Reports on the top ribbon. Then select Banking / Budgeting => Budget vs Actual

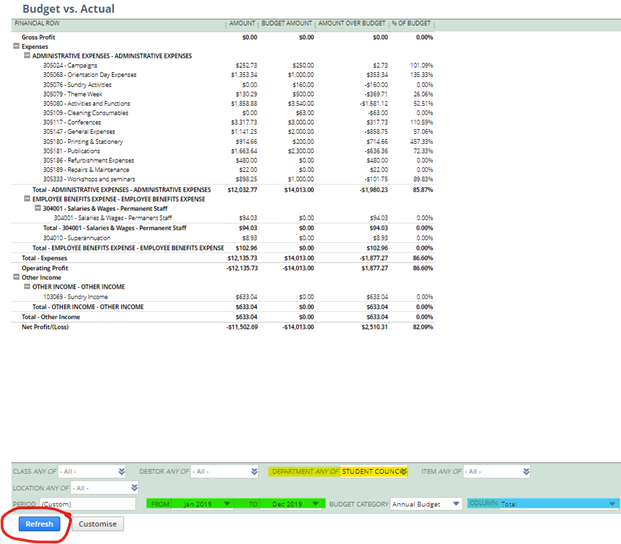

Your budget may look like this:

The expense line items e.g. 305079-Theme Week are also known as Budget Codes, Budget Categories, GL Codes, Expense Codes / Lines.

The menu bar at the bottom of the page (example below) allows you to:

- Department: Select your department.

- Period: Select the period for which you want to view your report. So if you want to view the report for January to March, select Jan 20XX in the ‘To’ box and Mar 20XX in the ‘From’ box.

- Column: Allows you to reformat the report to suit your needs, if you want to view the report for January to March with each month showing separately, select Accounting Period in the ‘Column’ box.

- Note: Always hit ‘Refresh’ after selecting your required changes in order to effect the changes.

- You also can PDF the report and convert it to Excel using the relevant icons.

Ignore ‘Class’, ‘Location’, ‘Debtor’, ‘Item’ buttons as these are not relevant for your purposes.

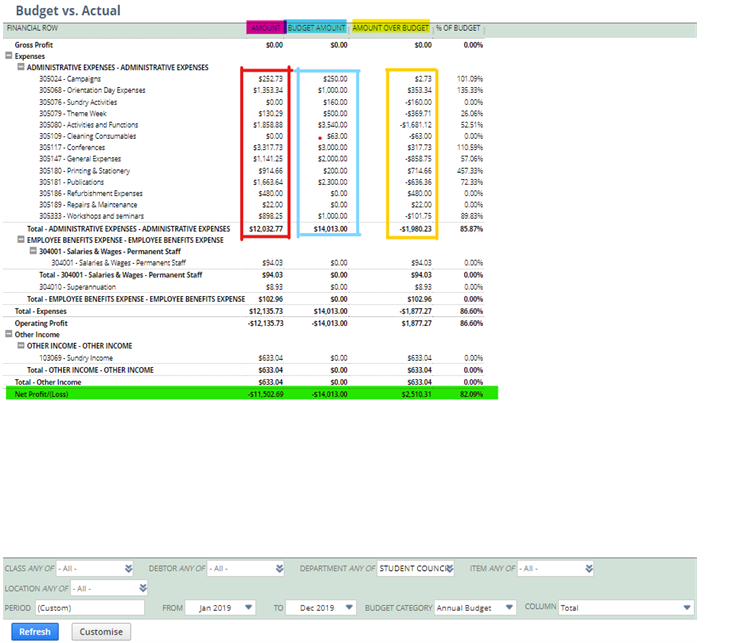

A: Generate the report detailed in the FAQ above.

- Red box represents the amounts you have spent

- Blue box represents the amounts budgeted

- Yellow box represents the amount over budget (If it’s positive, you are over budget)

It is okay to go over budget for some budget line as long as overall expenses are lower than budgeted (green highlights). For example on the above report, overall expenses is $11k when they are budgeted to spend $14k. This means they are under budget. Also as you might have noticed, because they have an income when they are not budgeted to earn anything, that “reduces” the expense amount and hence increase their budget. So if you earn more, you get to spend more! (More on this at Q6.)

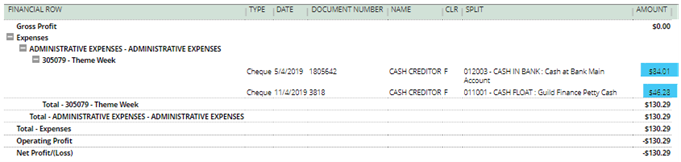

NetSuite also gives you the ability to drill down on the different expense lines to see what has been charged to your department. By selecting the dollar amount you can view all items that make up the total amount charged to your department. If you, for example, click on the $130.29 on Theme Week line (note: click the dollar amounts, not the account), the following will display below:

You can get further details on the entries above by again clicking on the dollar amounts (highlighted in blue above).

If it directed you to an error page, it could mean that that particular entry was shared between multiple departments and hence you could not view it as you are not the head of those departments. When this happens, drop an email to [email protected] and we will help you investigate what the entry is.

A: If you exceed your total budget, management and Guild Executive will be informed. Any additional costs incurred will need approval of the Guild President – if it is not approved and you have already spent money, you will not be allowed a reimbursement and will wear the cost personally. Therefore, you are strongly encouraged to check NetSuite regularly.

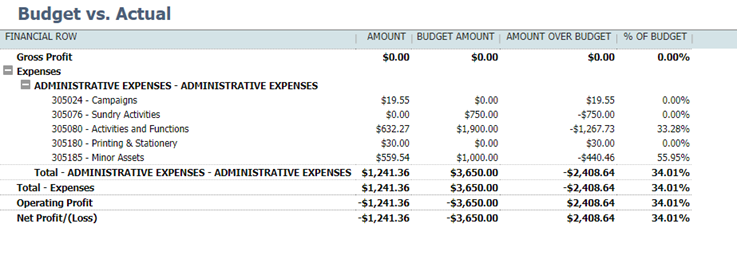

A: This is not a problem. A budget is a plan allocation of costs, not a fixed one i.e. if you want to spend your budget on some stationery but do not have a budget for this, you can still allocate costs to the stationery budget code so long as you spend less in one of your budgeted categories and do not exceed your total budget.

In the example below, printing and stationery costs of $30 was incurred even though there was no allocated budget (and campaigns also). This is not an issue as in the other budget categories, you can see that less has been spent than budget. The total amount spent is $1,241.36 compared to the budget of $3,650; you are within your total allocated budget.

A: If you cannot find a report to meet your requirements, please just email [email protected] and we can happily customise a report for your needs.

A: No, please do not hold on to any takings. All revenue must be deposited to the Guild Finance Office and then we can allocate it to your budget on NetSuite. It is important that all financial transactions are recorded on NetSuite so management, Guild Executive and future department representatives can see clearly what happened with the department’s finances.

We also need to account for tax on this revenue to ATO as we are a GST-registered entity.

Revenue earned will typically be allocated to Sundry Income, as income can never be allocated to an expense line.

A: Yes! If you need to split costs with another department, please just email [email protected] with the details of the cost and we can advise you on how to proceed. Approval will be required from the department sharing the cost.

A: Easy! Fill out this editable PDF form here and get it approved by your supervisor (either head of department or Guild President), and then just pass it on to Finance, giving us at least 24hr notice so we can prepare the float for you. When you come and collect the float, we will need you to sign on the same form to show receipt and then the float is yours!

Download Department Float Request Form

A: If you incur Guild related expenses from your own personal funds, you can be reimbursed up to $100 in cash from the Finance Office or by bank transfer for purchases over $100.

- Should only be used for Guild related purposes.

- All reimbursements require approval from your supervisor/President, no matter how much the reimbursement is, and anything above $500 require additional approval by Guild President/Directors.

- While prior approval of a purchase in this manner is not required, note that your supervisor can refuse to approve a reimbursement for any reason. As such, it is recommended you obtain email approval prior to incurring costs.

- A valid original copy of tax receipt/invoice must be provided when seeking reimbursement; without this the Finance Office will not reimburse you even if management approval has been obtained for the reimbursement. A photocopy of the receipt will be denied.

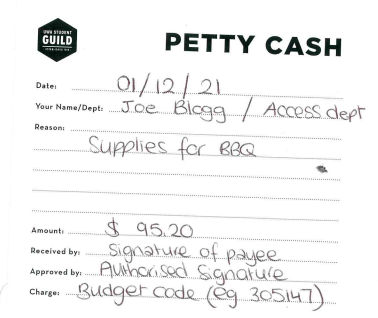

For cash reimbursements, a Petty Cash Slip can be found at the Finance Office. Once completed, approved and receipts attached, we will disburse the cash to you.

For bank transfer reimbursements, a Reimbursement Form is available at the Finance Office or downloadable here. Please allow 5 business days for all bank transfer reimbursements to be processed from the day it is submitted. If it is urgent, please inform us when you submit and if it is submitted before 12pm on the day, we will try to process it on the same day.

A: Yes! The Guild has a corporate credit card that can be signed out by completing the Credit Card Authorisation form (available at the Finance Office). The form must be signed by the person using the card as well as the supervisor of the department being charged. If the purchase is more than $500, an additional approval from the Managing Director, Guild President or Divisional Director is required.

Note that the Corporate Credit Card cannot be used in-store. Hence, all payments with the Corporate Credit Card would be online and the card is expected to be returned to Finance latest by close of business on the same day.

As with all other forms of purchases, a valid tax invoice / receipt will be required from your use of the card.

Alternatively, you can also use your own credit card and get reimbursed (please see Q11 on reimbursements for more information). Or if you are purchasing from the Coles Group, please read on to Q13.

A: Yes! Beside the corporate credit card, we also have Gift Cards for the Coles group available for use. Coles group includes:

- Coles

- Myer

- Target

- Kmart

- Coles Express

- Officeworks

- First Choice Liquor

- Vintage Cellars

- Liquorland

You would need to fill out the same orange form for Credit Card/Gift Card. Please see FAQ12 for more information.

These gift cards can only be used for in-store purchases and can’t be used for online purchases.

As with all other forms of purchases, a valid original tax invoice / receipt will be required from your use of the card.

A: Rather than paying for something personally and then being reimbursed by the Guild, you can request a supplier to invoice you for goods / services (purchase on credit) and the Finance Office will pay the approved invoice directly to the supplier.

Orders over $500

Please note a Purchase Order (PO) must always be completed and approved prior to placing an order for goods or services over $500. A PO is essentially an order issued to an external supplier, describing the product/service required, the quantity, agreed price etc

An exception to the previous point is for orders submitted to the Creative & Design department, orders for IT Equipment (including Software or Software Licensing), and orders involving Keys and Security; all orders submitted here will need a PO regardless of the purchase amount.

The PO book is available from the Finance Office. Please note that you are not permitted to retain the Purchase Order book, this book must always be returned to the Finance Office on the same day. The Finance Office will guide you on completing the Purchase Order book.

Once invoice has been received, sign it to confirm that the goods and services have been received and that it is in order to pay the invoice. Quote the PO number on the invoice too! Please read on for requirements for a valid invoice.

If the order is below $500, then the invoice can be signed by an the Head of Department (in the case where Head of Department is the one who ordered the goods/services, Guild President would have to approve) and submitted to the Finance Office. Also include the budget code as well as a Charge Department. Although a Purchase Order is not required for expenses under $500, prior approval should always be obtained from authorised department signatories before incurring costs.

Valid Invoices

Finally, when you receive the invoice, please ensure it has the following information before submitting it to us:

- Vendor’s Legal Name and Registered Business Address

- Vendor’s ABN – if the Vendor has no ABN – a Statement by a Supplier must be completed and the original submitted to the Finance Department. This is an ATO required document, without this the Guild must withhold 46.5% from payment. This form is available here

- Vendor’s Contact Details.

- Full Name and Address of the Guild as the billing address:

UWA Guild of Undergraduates

M300, 35 Stirling Highway

Crawley, WA 6009. - Invoice Number.

- Date the document is issued.

- Document states that it is a ‘Tax Invoice’.

- Goods / Services description, quantity, price.

- GST (as applicable): the invoice must be clear as to whether GST is payable.

- If the invoice is for multiple items, it should be clear what items are taxable supplies.

A: You can complete an Advance Payment form (available at the Finance Office) and have it approved by your supervisor. 1 business day notice is required for requests for cash advance payments between $500 and $1,000.

2 business day notice is required for requests for cash advance payments over $1,000.

A second signature is required from the Managing Director or Guild President for any payments over $500.

Once items are purchased, provide an original Tax Receipt or a Tax Invoice with proof of payment and any change to the Finance Office. Tax receipts/Tax invoice is to be submitted to Finance at least 2 business days after advance payment is taken.

Note: Failure to provide appropriate documentation for funds spent will result in a report being issued to management and Guild Executive and ability to make purchases on behalf of your department going forward will be jeopardy

A: Everyone elected to Guild Council gets automatic after-hour access to Guild building, lift to level 1, CCZ and Bob Nicholson Room. If you want subcommittees for departments to also have access or if you want access to other areas, you can request it through submitting the After Hour Access form which you can get from Finance office or download here.

A: Oh no! But don’t worry, come down to Finance office or give us a call (08 6488 2296) or email [email protected] and we’ll help you through it! (And then we’ll update the FAQ for you! 😊)